The promise to scrap the Alberta carbon tax was a major part of Jason Kenney’s successful election campaign. THE CANADIAN PRESS/David Rossiter

The promise to scrap the Alberta carbon tax was a major part of Jason Kenney’s successful election campaign. THE CANADIAN PRESS/David Rossiter

Jason Kenney has led the United Conservative Party to victory in Alberta. There were many objectionable components to the UCP campaign. One of the most ominous was Kenney’s promise to fight for the continued subsidization of Alberta’s dying fossil fuel industry.

Of course, Kenney didn’t phrase it that way.

He promised to eliminate the carbon price tax implemented by Rachel Notley’s NDP government. In fact, he pledged to Alberta voters it would be gone before the start of this summer’s Calgary Stampede.

When Kenney eliminates the Notley government’s carbon tax, Alberta will then be subject to the federal carbon pricing plan.

Conservatives unite

Kenney’s promise to fight the federal carbon tax aligns him with fellow premiers Doug Ford of Ontario, Blaine Higgs of New Brunswick and Scott Moe of Saskatchewan, as well as federal Conservative Leader Andrew Scheer.

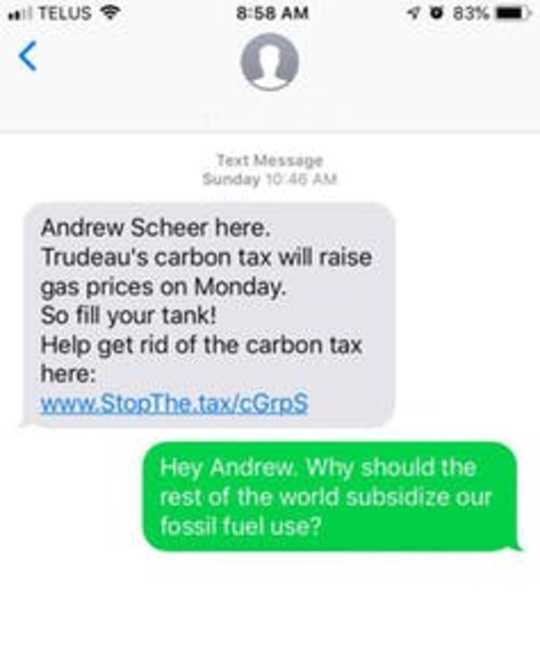

Screenshot of a mass text message from federal Conservative Leader Andrew Scheer and the author’s message in return. Scheer never responded.

Screenshot of a mass text message from federal Conservative Leader Andrew Scheer and the author’s message in return. Scheer never responded.

Scheer and his provincial counterparts, the most vocal opponents of Canada’s putting a price on carbon, are self-professed lovers of the free market. The Wall Street Journal recently cited Kenney’s expected victory as evidence of Albertans’ support for free markets. Scheer, Kenney, Ford, Higgs and Moe are individualists who believe the market properly rewards hard work. They claim to want minimal government, especially in all things economic.

According to free market ideology, government action prevents markets from functioning optimally. Among the biggest targets of the ideology are subsidies. According to free market supporters, subsidies distort prices, sending buyers and sellers the wrong signals, producing inefficiencies. And yet, in the denunciation of carbon taxes, opponents are really demanding the maintenance of a subsidy.

Although the federal government is imposing a cost on emissions through a tax, it is properly thought of as a price. Currently, we freely dispose of carbon and other emissions when we burn fossil fuels.

A carbon tax puts a price on those emissions. In theory, it makes us cover the costs associated with emissions and alters our behaviour toward consumption with lower emissions.

Markets are implicated in the climate crisis

For millennia, humans have burned fossil fuels for energy. However, over the last two centuries, the scale of fossil fuel use has increased dramatically. A commensurate rise in emissions has resulted.

Remarkably early in this history, there were scientists suggesting this is a problem. The Swedish Nobel laureate Svante Arrhenius argued in 1896 that carbon dioxide accumulation in the atmosphere could alter the Earth’s climate.

There is now effectively a scientific consensus that carbon and other emissions are dramatically altering our climate with a cascade of detrimental effects.

Fossil fuels offered a cheap, abundant and concentrated source of energy. However, cheapness was an illusion. Fossil fuel use was being subsidised by others.

Because the climate is global, the effects of climate change impose costs on people far removed in space from where the fossil fuels were burned. Because the effects of emissions take a while to emerge, they are imposing costs on people far removed in time from when the fossil fuels were burned.

Ontario Premier Doug Ford, left, and United Conservative Leader Jason Kenney embrace on stage at an anti-carbon tax rally in Calgary in October 2018. THE CANADIAN PRESS/Jeff McIntosh

Ontario Premier Doug Ford, left, and United Conservative Leader Jason Kenney embrace on stage at an anti-carbon tax rally in Calgary in October 2018. THE CANADIAN PRESS/Jeff McIntosh

One of the central ideological tenets of markets is that the beneficiary of a good also bears the cost of that good.

Markets hide subsidy

Every time we burn fossil fuels — whether to heat our homes or power our vehicles — and we do not pay to deal with the emissions, we are subsidized by those distributed in space and time who will pay in one way or another. Markets hid the subsidy with the low price paid for fossil fuels.

Most opponents of the carbon tax have accepted the science behind climate change, if grudgingly. Most even accept that it is caused by humans. Yet they refuse to recognize that markets are implicated in the crisis.

A carbon tax, as currently implemented by the federal government, is a bare minimum for addressing the climate crisis. The tax will have disproportionate effects on poor people and rural citizens. However, these should be addressed, as necessary, with targeted subsidies.

Explicit subsidies, on the books and subject to critical evaluation, are preferable to the clandestine subsidies to which carbon tax opponents feel entitled.![]()

About The Author

D.T. Cochrane, Lecturer in Business and Society, York University, Canada

This article is republished from The Conversation under a Creative Commons license. Read the original article.

Related Books

at InnerSelf Market and Amazon